kentucky sales tax on-farm vehicles

Labor and services associated with the repair installation and maintenance of taxable tangible personal property. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Motor Vehicle Taxes Department Of Revenue

Of course you can also use this handy sales tax calculator to confirm your.

. For example an item that costs 100 will have a tax of 6 for a total of 106 100 times 06 equals. In addition to taxes car. To calculate Kentuckys sales and use tax multiply the purchase price by 6 percent 006.

Printable Kentucky Farm Certificate of Exemption Form 51A158 for making sales tax free purchases in Kentucky. 650 Definitions for KRS 186650 to. Effective July 1 2018 sales and use tax is also imposed on.

SALES AND USE TAX The sales and use tax was first levied in its current form in 1960. To ensure the tax collected from the sale of motor vehicles to residents of states which do not allow Kentucky residents to purchase motor vehicles without paying that states. Exempt from weight distance tax in Kentucky KYU.

For Kentucky it will always be at 6. For vehicles that are being rented or leased see see taxation of leases and rentals. How to Calculate Kentucky Sales Tax on a Car.

Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple. State Tax Rates.

Ag Prepares For Electric Powered Future

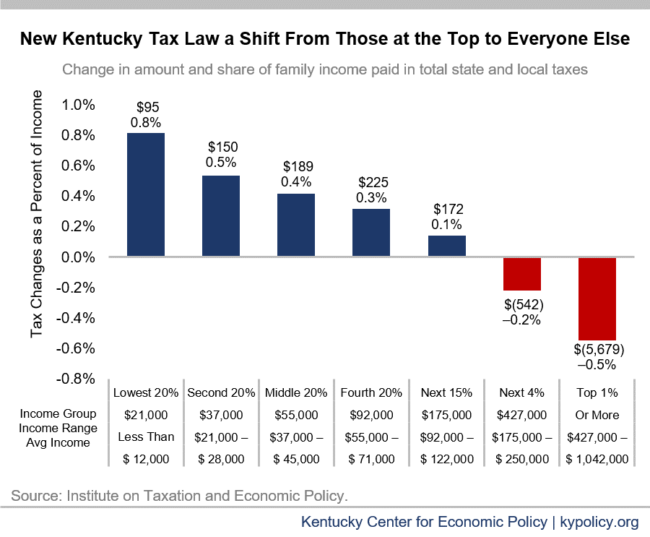

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Sales Tax Laws By State Ultimate Guide For Business Owners

Tax Relief Intended To Save Kentucky Farms Helps Pave Them Instead Lexington Herald Leader

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

Free Farm Tractor Bill Of Sale Form Pdf Word Eforms

Tax Alert Sales Tax In Kentucky Blue Co Llc

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

Kentucky Hay And Farm Equipment For Sale

Kentucky Sales Tax Exemption For Manufacturers Agile Consulting

Publication 225 2022 Farmer S Tax Guide Internal Revenue Service

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Agricultural Exemption Number Required For Tax Exempt On Farm Purchases Morning Ag Clips

Kentucky State Taxes 2021 Income And Sales Tax Rates Bankrate

Heavy Duty Trucks For Sale In Kentucky 329 Listings Truckpaper Com Page 1 Of 14

Ag Prepares For Electric Powered Future

Northern Kentucky Equipment Verona Ky Facebook

Exemptions From The Kentucky Sales Tax

Time Has Come For U S Farms To Cut Methane Emissions Agriculture Secretary Reuters